Trump’s Tariffs proposed implementation particularly on Chinese and European imports, has sparked renewed debates about global trade. In an increasingly interconnected global economy, political and economic decisions made in one part of the world often ripple across borders. While the immediate focus tends to be on the U.S. and its direct trade partners, the effects of these tariffs could extend far beyond. In this article, we explore how Trump’s tariff policies might influence the United Kingdom’s economy—especially in terms of mortgage rates that impact millions of homebuyers and homeowners.

Overview of Trump’s Tariffs

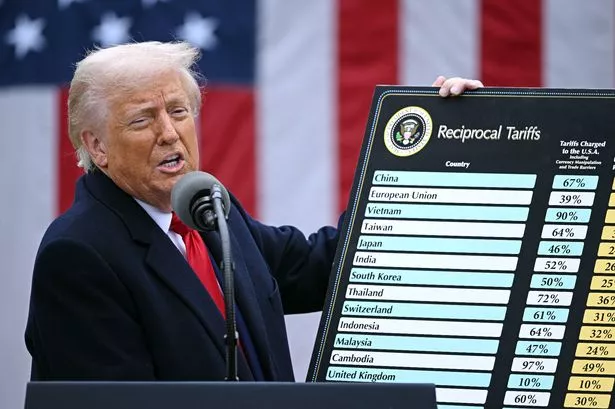

During his presidency, Donald Trump championed an “America First” economic agenda, prominently featuring tariffs on imported goods to protect domestic industries and reduce trade deficits. These tariffs primarily targeted China but extended to the European Union and other key trading partners. Trump had indicated intentions to reintroduce or expand these measures if re-elected. Now re-elected, Trump claims that a 10% tariff on all nations and much higher rates of up to 50% on individual countries will boost the US economy and protect jobs. His rationale is to revive U.S. manufacturing and reduce reliance on foreign production. However, such policies often provoke retaliatory measures, destabilizing global markets and trade flows.

Trump’s Tariffs Immediate Economic Reactions

The reintroduction of tariffs typically leads to immediate market volatility. Global stock markets react to the uncertainty, commodity prices shift, and currencies fluctuate. For instance, when tariffs are announced, investors often move toward “safe haven” assets like gold or the U.S. dollar. This flight to safety can strengthen the dollar and destabilize emerging markets, and it may also impact the euro and the British pound. The interconnectedness of financial markets means that UK investors and institutions will likely experience heightened volatility, with shifts in capital flows influencing interest rates and investment strategies.

Trump’s Tariffs Potential Impact on the UK Economy

The UK, while not directly targeted by Trump’s tariffs, remains vulnerable to the broader consequences of a global trade disruption. Reduced demand for goods and services, weakened investor confidence, and fluctuating exchange rates could all pose challenges. For example, if tariffs slow down the global economy, UK exports might decline due to reduced demand in the U.S. and China. Additionally, a strong U.S. dollar could lead to a weaker pound, raising the cost of imports and contributing to inflationary pressures. In response, the Bank of England might adjust monetary policy, including interest rates, to stabilize inflation and maintain economic growth.

Connection Between Economic Indicators and Mortgage Rates

UK mortgage rates are heavily influenced by a range of economic indicators, including inflation, interest rates set by the Bank of England, and overall market confidence. If inflation rises due to more expensive imports and a weaker pound, the Bank of England may raise interest rates to curb inflation. These changes directly affect mortgage rates, as lenders adjust their offerings in response to central bank policies. Furthermore, investor sentiment plays a role—if global uncertainty leads to a sell-off in UK government bonds (gilts), yields may rise, indirectly pushing up mortgage rates.

Forecasted Changes in Mortgage Rates

While it’s impossible to predict exact figures, analysts suggest that if Trump’s tariffs disrupt global supply chains and spark inflation, UK mortgage rates could rise in the short to medium term. Higher import costs, reduced consumer spending, and a potentially hawkish Bank of England would all contribute to upward pressure on rates. Conversely, if Trump’s tariffs lead to a significant economic slowdown, central banks might opt for rate cuts to stimulate growth, which could soften or reverse mortgage rate hikes. Much will depend on how the global economy absorbs the impact of the tariffs and how policymakers respond.

Implications for Homebuyers and Homeowners

For homebuyers, rising mortgage rates could mean higher monthly payments and reduced affordability. This might cool the housing market, leading to slower price growth or even price declines in certain areas. Homeowners with variable-rate mortgages could see their payments increase, while those on fixed-rate deals may be temporarily shielded but face higher costs when their terms expire. It’s advisable for potential buyers and current homeowners to monitor economic trends closely and consider locking in favorable rates when possible.

Conclusion

While Trump’s tariffs policies are primarily aimed at reshaping American trade relationships, their global economic repercussions could affect mortgage rates in the United Kingdom. From exchange rate volatility to inflation and monetary policy adjustments, the knock-on effects are complex and far-reaching. For UK consumers navigating the housing market, staying informed and proactive is crucial. Understanding how international trade dynamics intersect with domestic financial policies can help individuals make better financial decisions in uncertain times.

References

- Bank of England. (2024). Monetary Policy Report.

- Office for National Statistics (ONS). (2024). UK Inflation and Economic Indicators.

- BBC News. (2025). “Trump’s Tariff Talk: Global Markets React.”

- Financial Times. (2025). “Global Trade Under Pressure: Economic Fallout from U.S. Tariff Policies.”

- The Guardian. (2025). “What Trump’s Trade War Means for Britain.”

- Bloomberg. (2025). “Tariffs, Inflation, and Interest Rates: A Global View.”

Frequently Asked Questions (FAQs) about Trump’s Tariffs

1. How can tariffs imposed by the U.S. affect UK mortgage rates?

Trump’s Tariffs can lead to global economic uncertainty, impacting exchange rates, inflation, and central bank policies. In the UK, these factors influence the Bank of England’s interest rate decisions, which directly affect mortgage rates.

2. Are UK homeowners directly impacted by Trump’s Tariffs?

While not directly targeted, UK homeowners may face higher mortgage rates due to global inflation and market volatility caused by Trump’s tariffs, making borrowing more expensive.

3. What should UK homebuyers do if mortgage rates rise?

Homebuyers should consider locking in a fixed-rate mortgage to protect against future rate increases and stay informed about economic developments that may influence rates.

4. Could UK mortgage rates go down instead of up due to Trump’s tariffs?

Yes, if tariffs lead to a global economic slowdown, central banks might lower interest rates to stimulate growth, which could result in lower mortgage rates.

5. How do currency fluctuations affect mortgage rates in the UK?

A weaker British pound increases the cost of imports, driving inflation. In response, the Bank of England may raise interest rates to manage inflation, indirectly increasing mortgage rates.

6. What indicators should I watch to understand mortgage rate trends?

Keep an eye on UK inflation data, interest rate announcements from the Bank of England, exchange rate trends (especially GBP/USD), and global economic developments like U.S. trade policy.

7. How often can mortgage rates change in the UK?

Variable mortgage rates can change as often as the Bank of England adjusts interest rates. Fixed-rate mortgages remain constant for the agreed term, typically 2 to 5 years.