If you have recently opened your mail to find a letter (HMRC Nudge Letters) from HM Revenue & Customs (HMRC) regarding your property income, you are likely feeling a mix of confusion and anxiety. You aren’t alone. In 2026, HMRC has significantly ramped up its “one-to-many” mailing campaign, often referred to targeting residential landlords across the UK.

At Villian Accountants, we specialize in helping landlords navigate these letters through Let Property Campaign (LPC). This guide will walk you through exactly what these letters mean, the risks of ignoring them, and how you can resolve your tax position while minimizing penalties.

1. What Exactly is an HMRC Nudge Letter?

A nudge letter is not a formal tax enquiry or a notification of a criminal investigation. Instead, it is a “soft” prompt from HMRC’s data-driven system.

HMRC uses a sophisticated AI software called Connect. This system cross-references data from the Land Registry, letting agents, mortgage applications, and even sites like Airbnb or Booking.com. If the system identifies a person who owns multiple properties or has a buy-to-let mortgage but no corresponding rental income on their tax return, a nudge letter is triggered.

The letter essentially says: “We have information that suggests you may have rental income. Please check your records and let us know if you need to pay tax.”

2. Why Have I Received This Nudged Letter Now?

HMRC’s “Connect” system is more powerful than ever. Common triggers for receiving a nudge letter in 2026 include:

- Land Registry Updates: You purchased a second property or changed the title deeds.

- Tenancy Deposit Schemes: Your tenant’s deposit was registered, creating a digital paper trail.

- Stamp Duty Records: Historical data from when you purchased the property.

- Third-Party Reporting: Letting agents are now legally required to provide HMRC with lists of landlords they represent.

3. The “Certificate of Tax Position”: The Hidden Trap Nudged letters

Most nudge letters include a document called a Certificate of Tax Position. HMRC asks you to sign and return this within 30 days.

Warning: This certificate is not a statutory requirement. You are not legally obligated to sign it.

Why you should be cautious:

The certificate asks you to declare one of the following:

- My tax affairs are up to date.

- I have some additional tax to disclose.

- I have not been a landlord during the period.

If you sign the certificate stating your affairs are up to date, and HMRC later finds an error, you could face criminal prosecution for “Dishonest Disclosure” or “Perjury.” It is almost always better to have an accountant respond with a formal letter on your behalf rather than signing this specific HMRC document.

4. The Let Property Campaign (LPC): Your “Amnesty”

If you realize you do owe tax, the best route for resolution is the Let Property Campaign. This is a specific disclosure facility for individual landlords renting out UK residential property.

The Benefits of the LPC:

- Lower Penalties: By coming forward via the LPC (an “unprompted disclosure”), your penalties can be as low as 0% to 20%. If you wait for HMRC to start a formal investigation (a “prompted disclosure”), penalties can soar to 100% or even 200% for offshore income.

- Fixed Timeline: Once you notify HMRC, you have a clear 90-day window to calculate and pay.

- Manageability: It allows you to wrap up multiple years of tax into one single settlement rather than filing dozens of individual backdated tax returns.

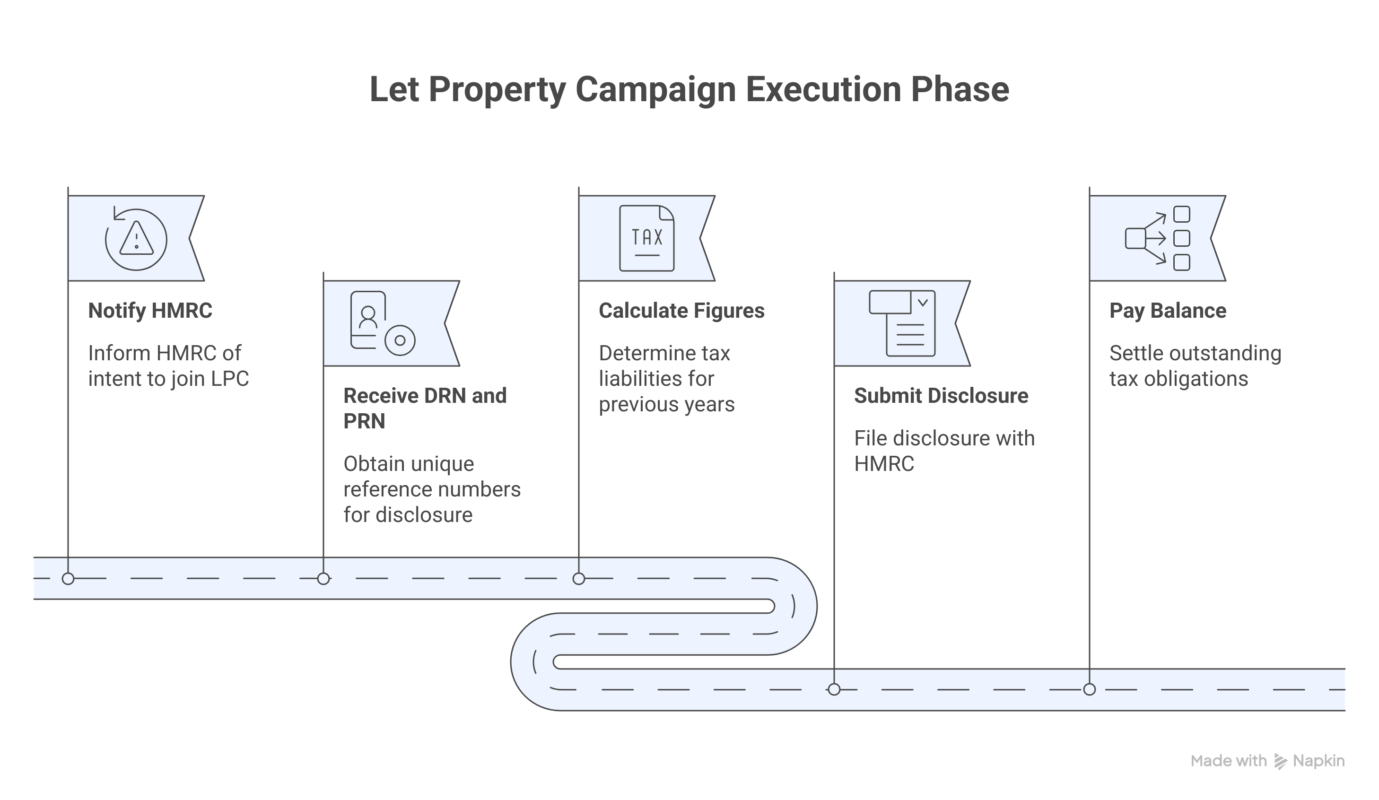

5. Step-by-Step: How to Respond to Your Nudge Letter

Step 1: Review Your Records

Don’t rely on memory. Gather your bank statements, letting agent statements, and mortgage interest certificates for the last several years. You need to calculate your actual profit, not just your total rent.

Step 2: Seek Professional Advice

Before replying to HMRC, speak to a specialist like Villian Accountants. We can perform a “Pre-Disclosure Check” to see exactly how much you owe and whether you have a “Reasonable Excuse” for the delay (which can further reduce penalties).

Step 3: Notify HMRC of Intent

We will register you for the Let Property Campaign. This “stops the clock” on further HMRC action and gives us 90 days to prepare the figures.

Step 4: Calculate the “Full Picture”

This involves:

- Total Rental Income.

- Deducting Allowable Expenses (Maintenance, agent fees, insurance, etc.).

- Calculating the Section 24 Tax Credit for mortgage interest.

- Adding statutory interest and the correct penalty percentage.

Step 5: Submission and Payment

Once the disclosure is submitted and the tax is paid, HMRC usually issues an acceptance letter within a few weeks, bringing the matter to a permanent close.

6. What If I Don’t Owe Any Tax?

Sometimes, HMRC gets it wrong. You might have received a letter even if:

- Your rental income is below the £1,000 Property Allowance.

- You are letting a room in your own home under the Rent-a-Room Scheme (below £7,500).

- The property is owned by a Limited Company, and you’ve already paid Corporation Tax.

Even if you owe nothing, do not ignore the letter. You must still respond to explain why no tax is due. Ignoring the “nudge” will almost certainly lead to a formal, much more intrusive tax enquiry.

7. How Far Back Will HMRC Look?

One of the most common questions we hear is: “How many years do I need to pay for?” The answer depends on your “behaviour”:

| Behaviour | Look-back Period |

| Reasonable Care (You tried to get it right but failed) | 4 Years |

| Careless (You didn’t pay enough attention to your tax) | 6 Years |

| Deliberate (You knew you should pay but chose not to) | 20 Years |

At Villian Accountants, our job is to argue for the lowest possible category based on your specific circumstances.

8. Summary: The Cost of Delay

The difference between acting now and waiting for a formal investigation can be tens of thousands of pounds.

- Scenario A (Proactive): You use the LPC. You pay the tax + interest + 10% penalty.

- Scenario B (Reactive): HMRC opens an enquiry. You pay the tax + interest + 70% penalty + potential “Naming and Shaming” on the HMRC website.

Frequently Asked Questions (FAQs)

Q1: Can I just start filing my next tax return correctly and forget about the past?

No. HMRC’s systems look backward. Filing a correct return now might actually “flag” the fact that you owned the property in previous years, triggering an enquiry into your history.

Q2: What if I don’t have receipts from 5 years ago?

We can use “Reasonable Estimates.” HMRC allows for the reconstruction of records using bank statements and average costs for the period, provided the figures are sensible and defensible.

Q3: I live abroad; does the Let Property Campaign apply to me?

Yes. If you own property in the UK, you are liable for UK tax regardless of where you live. There is also a “Non-Resident Landlord Scheme” you should be aware of.

Q4: Will I go to prison for undeclared rent?

Criminal prosecution is extremely rare for landlords who come forward voluntarily via the Let Property Campaign. HMRC’s primary goal is to collect the tax, not to fill prison cells. However, ignoring letters increases your risk significantly.

Q5: How much does it cost to have Villian Accountants handle this?

We offer a transparent, fixed-fee service for LPC disclosures. Most clients find that the tax and penalties we save them far outweigh our fees.

Take Control of Your Tax Position Today

If you’ve received a nudge letter, the clock is already ticking. Don’t let a simple mistake turn into a legal nightmare.

Contact Villian Accountants for a confidential consultation. We will review your letter, assess your records, and handle HMRC so you don’t have to.

1. What happens if I can’t pay the full amount by Day 90?

HMRC is a debt collector, but they are also pragmatic. If the calculation reveals a bill you can’t settle instantly, we can propose a Time to Pay (TTP) arrangement.

- The Rule: You must ask before the 90-day deadline.

- The Result: HMRC typically allows payments to be spread over 6–12 months if you’ve been transparent and cooperative.

2. Can I include the sale of a property in my LPC disclosure?

Yes. While the campaign is named “Let Property,” HMRC requires a full disclosure of all “tax gaps.” If you sold a rental property and forgot to pay the Capital Gains Tax (CGT), we include it here.

Note for 2026: The CGT rate for residential property currently sits at 18% (basic rate) and 24% (higher rate).

3. I heard Furnished Holiday Lets (FHLs) lost their tax perks?

Good eye. As of April 6, 2025, the special FHL tax regime was abolished. For your LPC disclosure, this means that for any years after that date, your holiday let is treated just like a normal long-term rental—you can no longer claim full mortgage interest relief or certain capital allowances. We will ensure your 90-day calculation reflects this shift.

4. Why is the interest rate 7.75%? That feels steep.

Statutory interest is pegged to the Bank of England base rate. As of January 9, 2026, the rate is 7.75%. It’s important to remember that interest is “non-negotiable” and not a penalty; it’s simply the cost of the money being in your pocket instead of the Treasury’s for the last few years.

5. Will this trigger an audit of my other businesses?

Usually, no. The LPC is a “walled garden.” If your disclosure is honest, full, and the figures “make sense” (i.e., they align with the Land Registry data HMRC already sees), they typically issue an acceptance letter and move on. They are looking for the “tax gap,” not a reason to spend 200 hours auditing your unrelated consultancy business.

6. How does “Making Tax Digital” (MTD) affect my disclosure?

If your gross rental income (plus any self-employment income) exceeds £50,000, you are required to join MTD for Income Tax starting April 2026.

- Joining the LPC now is actually the perfect “cleanup” before the MTD era begins.

- It ensures your “Opening Balance” with HMRC is clean before you start submitting quarterly digital updates.

7. What if I inherited the property and didn’t know I had to pay tax?

This is one of the most common scenarios. In HMRC’s eyes, this usually falls under “Careless” rather than “Deliberate.” This is great news for your wallet—it means the penalty could be as low as 0% to 15% of the tax due, provided you tell them everything before they come knocking.