PAYE, or Pay As You Earn, is the system by which employers deduct Income Tax and National Insurance Contributions (NICs) directly from an employee’s salary or wages and remit them to HM Revenue & Customs (HMRC) on the employee’s behalf. It ensures that employees pay their tax in real-time, aligning payments with earnings, rather than […]

If you’ve recently looked at your payslip and felt something seemed off—maybe your take-home pay dropped or you’ve been taxed unexpectedly—your tax code could be the culprit. In the UK, your tax code (such as the common 1257L tax code) plays a vital role in determining how much Income Tax your employer deducts from your […]

Local Government Pension Scheme reform is underway, with the UK government set to consolidate 86 LGPS funds into 8 large-scale investment pools by 2026, known as “pension megafunds.” This move, known as the 2026 pension consolidation, is expected to unlock around £80 billion for strategic investments in UK infrastructure, technology, and green energy. For millions […]

If you’re planning your retirement in the UK, understanding the latest pension changes is critical—especially as we approach 2026, when a major update to the state pension system comes into effect. The UK state pension has long served as a financial safety net for millions, providing regular income to retirees who meet specific eligibility criteria. […]

It’s Not About Evasion, It’s About Efficiency Every self-employed individual wants to reduce their tax bill, but it’s crucial to distinguish between illegal tax evasion and legal tax planning. Effective tax planning involves using the full range of allowances, reliefs, and structures that HMRC provides to ensure you pay no more tax than is legally […]

UK rental income tax obligations are crucial to understand for anyone involved in letting property. As of the 2025/26 tax year, rental income is taxed in line with standard income tax bands, making it essential for landlords to be aware of their tax liabilities. This knowledge helps in accurate financial planning and ensures compliance with […]

Inledning: Varför färger har en djupare betydelse i kultur och historia Färger är mer än bara visuella element – de fungerar som kraftfulla symboler för identitet, tillhörighet och kulturell historia. I mänsklig kommunikation kan färgval påverka känslor, attityder och till och med beslut. Färgen lila, i synnerhet, har en rik kulturell och historisk betydelse, som […]

The Department for Work and Pensions (DWP) has announced several updates effective June 2025, impacting recipients of Personal Independence Payment (PIP), Universal Credit, and State Pension. These changes aim to provide enhanced financial assistance to eligible individuals. June 2025 DWP Updates : Personal Independence Payment (PIP) Adjustments Starting June 2025, PIP rates have been increased […]

In the UK, staying compliant with personal tax obligations is crucial to avoid financial penalties and maintain good standing with HM Revenue & Customs (HMRC). Failing to meet tax responsibilities—such as submitting returns late, underreporting income, or missing payment deadlines—can result in significant fines and interest charges. For instance, as of May 1, 2025, individuals […]

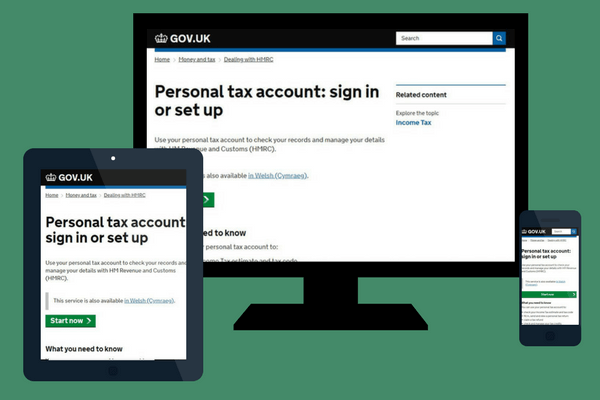

Introduction Purpose of the Personal Income Tax Account The HMRC Personal Tax Account is an online platform designed to simplify the way individuals in the UK manage their personal tax affairs. Launched by HM Revenue & Customs (HMRC), this secure digital service provides taxpayers with real-time access to a wide range of tax-related information and […]