Bank reconciliation is the process of comparing your business’s financial records with the transactions listed on your bank statement to ensure both sets of data align. It helps identify discrepancies such as missing payments, double charges, or bank errors, all of which can impact your financial accuracy and tax reporting.

In the UK, a surprising number of businesses either delay or completely overlook this vital task. According to recent surveys by UK accounting platforms like Xero and QuickBooks, up to 45% of small business owners admit they don’t reconcile their accounts regularly. This leads to common issues such as cash flow mismanagement, inaccurate tax filings, and even unnoticed fraud or bank errors — all of which can jeopardise the financial health of a business.

This article is designed to help you understand why bank reconciliation matters so much for UK businesses, especially in today’s digital tax environment, and how to do it properly -whether you’re a sole trader, a limited company, or managing finances for a growing enterprise. We’ll walk through what the process involves, why it’s crucial for your business success, and provide a simple, practical approach to doing it right.

What Is Bank Reconciliation?

Bank reconciliation is the process of matching the financial records in your accounting system with the transactions listed on your actual bank statement. The goal is to ensure that both sources reflect the same balances and activity for a given period. If differences exist, they need to be investigated and corrected.

For example, your accounting records might show a customer payment as received, but it hasn’t yet appeared on your bank statement. This could be due to timing delays, such as cheque clearance or bank processing times. Alternatively, a bank fee might be listed on your statement but not yet recorded in your books. These differences, if left unchecked, can lead to inaccurate reporting, cash flow misjudgments, or even tax filing issues.

In the UK, this process is particularly important for maintaining HMRC-compliant records, managing VAT returns accurately, and meeting the requirements of Making Tax Digital. Most modern UK businesses use cloud accounting platforms like Xero, QuickBooks, or FreeAgent, which provide automated bank feeds to simplify the reconciliation process.

By regularly reconciling your bank transactions, you ensure your accounts reflect the true financial position of your business. It’s not just about avoiding mistakes, it’s also about building confidence in your financial decisions.

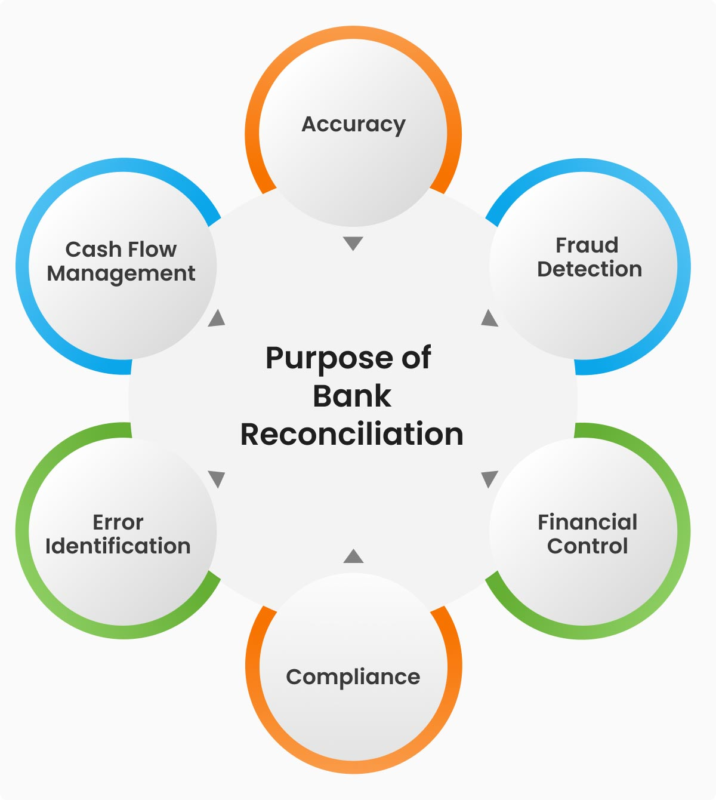

Why Bank Reconciliation Is Essential for UK Businesses

Bank reconciliation is more than just a routine accounting task, it plays a crucial role in ensuring the financial health, accuracy, and credibility of your business. In the UK, where businesses are subject to strict reporting and tax compliance requirements, reconciling your accounts regularly can help you stay ahead of potential issues and avoid penalties.

- Detects errors and fraud early

Reconciling your accounts helps you spot discrepancies quickly, such as duplicate charges, missed payments, or unauthorised transactions. Early detection allows you to address issues before they spiral into larger problems. - Ensures accurate cash flow

Without bank reconciliation, your books may show an inflated or understated cash balance. This can mislead your budgeting, purchasing, or investment decisions. Accurate reconciliation gives a clear picture of how much cash your business truly has available. - Supports tax compliance

Proper reconciliation ensures all income and expenses are accurately recorded, which is essential for preparing VAT returns, corporation tax, or self-assessment. Mistakes can lead to overpaying tax, underpaying, or being flagged for an HMRC audit. - Aligns with Making Tax Digital requirements

Making Tax Digital (MTD) requires UK businesses to maintain digital records and submit returns using compatible software. Accurate, reconciled accounts make this process easier and reduce the risk of errors during submissions. - Builds financial credibility

Whether you’re applying for a loan, seeking investment, or undergoing due diligence, clean and reconciled books demonstrate that your business is well-managed and financially sound.

How Often Should UK Businesses Reconcile Their Accounts

The frequency of bank reconciliation depends on the size of your business, the volume of transactions, and the complexity of your financial activity. However, for most UK businesses, monthly reconciliation is the minimum recommended standard. In some cases, weekly or even daily reconciliation may be more appropriate.

- Sole traders and small businesses

If you run a small business or operate as a sole trader with a moderate number of transactions, reconciling your bank account once a month is generally sufficient. This allows you to keep your accounts current, spot any issues in time for month-end reporting, and prepare accurate tax returns. If your business handles a lot of cash, has irregular income, or uses multiple payment platforms, you may benefit from doing it bi-weekly or weekly. - Medium to large businesses

Businesses with higher transaction volumes, multiple bank accounts, or payroll responsibilities should ideally reconcile their accounts weekly. This ensures greater control over cash flow, helps with forecasting, and reduces the risk of errors building up over time. - High-risk or high-activity businesses

E-commerce platforms, retail shops, and service providers who receive daily payments from customers via card, PayPal, Stripe, or other platforms should consider daily reconciliation. With automated software like Xero or QuickBooks, daily reconciliation is more achievable and can help prevent serious financial discrepancies. - During VAT quarters or year-end

Even if you reconcile monthly or weekly, additional reconciliation should always be done before submitting VAT returns or at the end of the financial year. This ensures your records are accurate and fully aligned before reporting to HMRC. - When using automated software

If you use bank feeds in software like QuickBooks, Xero, or FreeAgent, reconciliation becomes quicker and easier. These tools can automatically import transactions and match them to your records, making it possible to reconcile as often as you like with minimal effort.

In summary, there is no one-size-fits-all rule. However, the more frequently you reconcile, the less likely you are to run into costly errors or delays. Make it a regular part of your financial routine, and schedule it the same way you would other key business tasks.

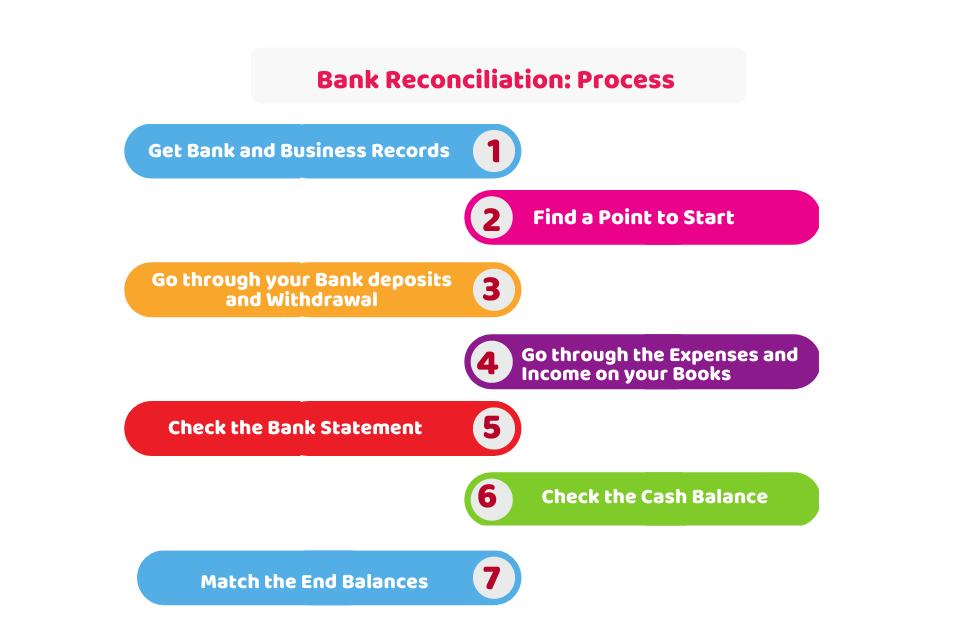

How to Do Bank Reconciliation Step-by-Step

Bank reconciliation may sound technical, but when broken into steps, it’s a clear and manageable process. Whether you’re doing it manually or using accounting software, the objective is to ensure your business records match your bank statement for a given period.

Follow these steps to complete a typical bank reconciliation in the UK:

- Gather your bank statement and accounting records

Start by collecting the most recent bank statement for the period you want to reconcile. Then open your accounting records, which could be a spreadsheet, manual ledger, or software like Xero or QuickBooks. Make sure you’re comparing the same date range on both sources. - Match transactions line by line

Go through your bank statement and compare each transaction with what’s in your accounting records. For every payment received, withdrawal, bank fee, or transfer, there should be a matching entry in your books. In accounting software, this is often automated, but always double-check for unmatched entries. - Ensure that the opening balances (that is, balance at the start) of the two accounts are equal (that is, balance of our bank account in your books and bank statement) are on opposite sides.

- Investigate any discrepancies

If a transaction appears on your bank statement but not in your records (or vice versa), note it down and investigate. Common causes include: - Transactions that have been recorded in your accounting system but haven’t yet cleared the bank (known as outstanding payments)

- Bank charges or interest not yet entered in your records

- Duplicate entries or data entry errors

- Missed deposits or receipts

Once identified, make the necessary corrections in your records. - Adjust your records where needed

Update your accounting software or ledger to reflect any missing items such as bank fees, direct debits, standing orders, or interest. If errors were found, correct them with proper documentation and notes so there’s a clear audit trail. - Check your final balance

After adjustments, compare the adjusted balance in your accounting records with the closing balance on your bank statement. If they match, the account is successfully reconciled. If not, go back and look for any remaining discrepancies. - Save the reconciliation report

If you’re using accounting software, generate and save the reconciliation report. If you’re doing it manually, keep a clear summary of what was reconciled and any adjustments made. This will be important for tax reporting, audits, or future reviews. - Schedule your next reconciliation

Make it a habit to reconcile your accounts regularly, based on your business needs. Mark your calendar or set reminders to avoid falling behind.

Reasons for differences and How to Avoid Them

While bank reconciliation is a vital part of financial management, many UK businesses encounter the same mistakes repeatedly. These errors can cause confusion, distort your accounts, and even lead to tax issues if left unchecked. Being aware of these common pitfalls helps ensure you perform accurate and effective reconciliations.

- Duplicate entries

One of the most common issues is recording the same transaction more than once. This can happen when importing transactions manually or when a bank feed re-syncs. Always check for repeated transactions, especially when reconciling over multiple periods. - Missing bank charges or interest

Bank fees, overdraft interest, and other automatic deductions often go unnoticed unless you actively compare your statement with your records. If these aren’t recorded, your books won’t reflect the actual cash position. Always look out for charges listed on your bank statement that haven’t been entered into your accounting software. - Timing differences

Payments might appear in your accounts but not yet show on your bank statement, especially around weekends, holidays, or if you’ve received a cheque. These are known as outstanding transactions. They’re not mistakes, but they do need to be tracked carefully to avoid confusion. - Misclassified transactions

Placing a transaction in the wrong category (for example, recording a loan repayment as an expense) can throw off your profit and loss report and cause reconciliation issues. Regularly review categories and consult with a bookkeeper or accountant when unsure. - Manual data entry errors

Mistakes such as typing the wrong amount, entering a date incorrectly, or missing a decimal point can easily go unnoticed. These small errors can lead to significant reconciliation discrepancies. Always double-check manual entries and use bank feeds where possible to reduce human error. - Not reconciling regularly

Leaving reconciliation until the end of the quarter or financial year can make the process overwhelming and error-prone. Transactions pile up, and errors become harder to track. Set a consistent schedule and stick to it, whether weekly or monthly. - Forgetting to save reports or documentation

Failing to document what you did during reconciliation can cause problems later during tax time or an audit. Always save your reconciliation reports and any notes on adjustments or corrections you made.

Avoiding these common pitfalls doesn’t require advanced accounting knowledge, rather just attention to detail and consistency. With the right habits and tools, bank reconciliation can become a fast, routine part of managing your UK business finances.

Recommended Software for Bank Reconciliation in the UK

Modern accounting software has made bank reconciliation faster, more accurate, and less stressful. In the UK, there are several well-established platforms that support automatic bank feeds and provide tools to simplify the reconciliation process. Here are some of the most popular options:

- Xero

Xero is widely used among UK small businesses, accountants, and bookkeepers. It offers automatic bank feeds with most UK banks, which means your transactions are imported daily. The reconciliation screen allows you to match transactions with just a few clicks, and unmatched items are flagged clearly. Xero also includes rules that help automate common entries like regular payments or transfers. - QuickBooks Online

QuickBooks is another leading option, especially popular among sole traders and freelancers. Like Xero, it supports automatic bank feeds and offers a straightforward reconciliation interface. QuickBooks helps identify unmatched transactions and allows you to reconcile accounts monthly with detailed reports. It also integrates well with other business tools for invoicing, payroll, and tax management. - FreeAgent

Designed specifically for UK freelancers, contractors, and small businesses, FreeAgent includes strong bank reconciliation features tailored to Making Tax Digital requirements. It supports bank feeds and provides colour-coded flags for unreconciled entries. It’s ideal for users looking for a lightweight but compliant platform with a UK tax focus. - Sage Accounting

Sage offers both desktop and cloud solutions, with its cloud version including reconciliation tools and bank feed integration. It’s a good choice for businesses that require more robust accounting features alongside reconciliation, especially those with in-house accounting teams or more complex needs. - Tide and Starling Bank integrations

If you’re a UK business banking with digital-first banks like Tide or Starling, both offer direct integration with accounting software and real-time transaction updates. This makes reconciliation even faster and more efficient without needing to import or manually upload statements.

Choosing the right tool depends on the size of your business, your accounting needs, and your comfort level with digital platforms. Most offer free trials or demos, so it’s worth testing a few to find the one that fits your workflow best.

Conclusion

Bank reconciliation is one of the most important financial tasks a UK business can perform to maintain control, accuracy, and compliance. Whether you’re a sole trader, a growing SME, or managing a limited company, ensuring that your internal records match your bank statements helps you stay financially healthy, avoid costly errors, and meet your reporting obligations to HMRC.

By understanding what reconciliation involves, performing it regularly, and using modern accounting tools, you can simplify the process and build confidence in your financial data. It’s not just about ticking boxes — it’s about protecting your business, improving decision-making, and staying ahead of tax deadlines.

If you haven’t already, make bank reconciliation a consistent part of your monthly routine. Doing so can save you time, money, and stress down the line.

Frequently Asked Questions (FAQ)

How often should I reconcile my bank account?

Most UK businesses should reconcile monthly at a minimum. If you handle high volumes of transactions or manage cash flow closely, weekly or even daily reconciliation is ideal.

What is the bank reconciliation process UK?

Bank reconciliation is the process of aligning your financial records with your bank’s monthly statements. This routine check ensures both records match, helping you spot any discrepancies, errors, or fraud. It’s a vital financial health check for your business, providing clear insight into your finances.

What are the 4 major parts of bank reconciliation?

The four steps in bank reconciliation are (1) accessing and comparing deposits between a company’s bank statement and its internal systems of record, (2) normalizing the bank statement as needed, (3) formatting of data from internal systems of record, and (4) comparing the bank statement and internal records to confirm.

What is the difference between a bank reconciliation and a balance sheet reconciliation?

Balance sheet reconciliation is the process of reviewing transactions on your overall balance sheet, while bank reconciliations focus specifically on bank statements and cash accounts. They’re almost identical processes, save for their scope and the type of transactions being reconciled

Who prepares a bank reconciliation statement?

Typically, the task falls under the domain of an organization’s accounting or finance department. Trained accountants or financial experts, equipped with an acute attention to detail and an in-depth grasp of financial intricacies, meticulously prepare the reconciliation statement.

Do I need accounting software to do bank reconciliation?

No, but it helps. You can do reconciliation manually using spreadsheets and bank statements, but software like Xero, QuickBooks, or FreeAgent speeds up the process and reduces the chance of errors.

Can I do bank reconciliation myself as a sole trader?

Yes. Many sole traders in the UK handle their own bank reconciliation. However, using software or consulting an accountant can make the process easier and ensure accuracy, especially when filing taxes.

What if my bank balance doesn’t match my records?

Start by checking for outstanding transactions, missing bank fees, or duplicate entries. Review your transactions line by line and correct any errors found. If you’re unsure, it’s wise to ask a bookkeeper or accountant for help.

Is bank reconciliation required by law in the UK?

It’s not legally required to reconcile in a specific way, but accurate recordkeeping is required by HMRC. Regular reconciliation supports compliance, especially under Making Tax Digital rules.