Financial reporting is a critical aspect of business operations for small and medium-sized enterprises (SMEs) in the United Kingdom. Accurate and timely financial statements not only ensure compliance with legal requirements but also provide valuable insights for decision-making and maintaining stakeholder trust. This article outlines the current financial reporting standards applicable to SMEs, recent regulatory […]

Author Archives: Villian

For many small businesses in the UK, cash flow isn’t just a financial term—it’s the lifeblood of daily operations. Even profitable businesses can fail if they run out of cash. That’s why cash flow forecasting is essential. It allows business owners to anticipate cash shortages, plan ahead for tax obligations, and make informed decisions about […]

HMRC self assessment sole trader filing is a legal requirement for individuals who earn above the tax-free personal allowance or have untaxed income from self-employment, rental properties, investments, or other sources.. It allows HMRC to calculate how much income tax and National Insurance you owe based on your declared earnings and allowable expenses. While the […]

Welcome to Self-Employment (Don’t Panic About Tax!) Taking the leap into self-employment is an exciting step, offering freedom and control over your career. However, it also brings new responsibilities, and for many, the biggest source of anxiety is completing the Self Assessment tax return. A self assessment guide can be an invaluable tool during this […]

UK tax relief is often overlooked, causing millions of UK taxpayers each year to pay more than necessary by missing out on legitimate reliefs they could legally claim.. From self-employed workers missing out on business-related deductions to PAYE employees unaware of allowances like Marriage Allowance or tax-free pension contributions, these unclaimed benefits can quietly add […]

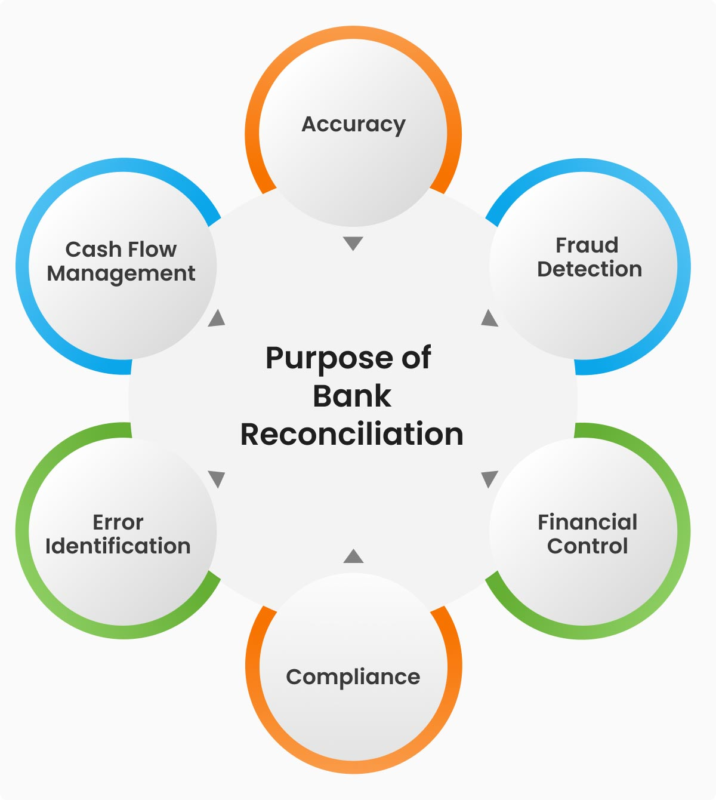

Bank reconciliation is the process of comparing your business’s financial records with the transactions listed on your bank statement to ensure both sets of data align. It helps identify discrepancies such as missing payments, double charges, or bank errors, all of which can impact your financial accuracy and tax reporting. In the UK, a surprising […]

The “150% Tax Bill” Surprise For those new to Self Assessment, the first tax bill can bring a nasty surprise. After carefully calculating the tax owed for your first year of trading, you may find HMRC is demanding that amount, plus an extra 50% on top. This is due to a system called Payments on […]

The Rise of the Side Hustle and the Taxman’s Interest The side hustle has become a cornerstone of the modern UK economy. Whether it’s selling crafts on Etsy, driving for Uber, or turning a hobby into a source of extra income, millions of people are earning money outside of their main job, often driven by […]

The VAT “Cliff Edge” and What It Means for Your Business For a growing small business in the UK, crossing the VAT (Value Added Tax) threshold is a major milestone. VAT is a tax added to the price of most goods and services, which VAT-registered businesses must charge to their customers and then pay to […]

The Fear of the Brown Envelope For millions of self-employed people across the UK, there are few things more dreaded than the sight of a brown envelope from HMRC landing on the doormat, especially after a tax deadline has passed. The penalty system for Self Assessment can seem complex and unforgiving, and with millions of […]